FINANCIAL OVERVIEW

WHIRLPOOL CORPORATION

Our ability to consistently move the business

forward with discipline, innovation and speed

continues to strengthen our industry leadership

and produce the value-creating results our

shareholders expect.

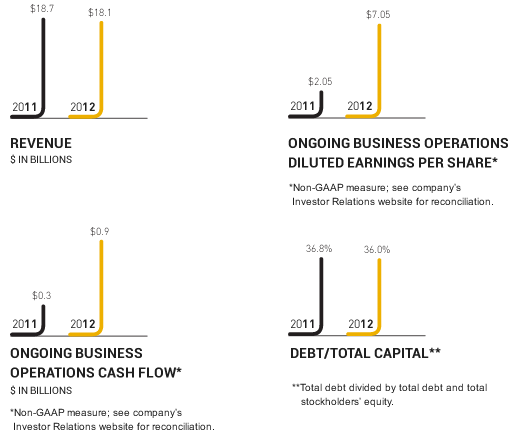

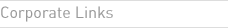

FINANCIAL SUMMARY

The following is a brief summary of Whirlpool Corporation’s financial condition and results of operations for 2012, 2011, and 2010. For a more complete understanding of our financial condition and results, this summary should be read together with Whirlpool Corporation’s Consolidated Financial Statements and related notes, and “Management’s Discussion and Analysis.” This information appears in the Financial Supplement to the Company’s Proxy Statement and in the Financial Supplement to the

2012 Annual Report on Form 10-K

filed with the Securities and Exchange Commission, both of which are also available on the company's website at www.WhirlpoolCorp.com.

GROWTH THROUGH GEOGRAPHIC EXPANSION

Sales by Region

FORWARD-LOOKING PERSPECTIVE

We currently estimate earnings per diluted share and industry demand for 2013 to be within the following ranges:

2013

Outlook

Outlook

Estimated GAAP diluted earnings per share,

for the year ending December 31, 2013

for the year ending December 31, 2013

$9.80–$10.30

Including:

BEFIEX credits

Restructuring expense

U.S. Energy Tax Credits [1]

Restructuring expense

U.S. Energy Tax Credits [1]

$(0.81)

$1.75

$(1.50)

$1.75

$(1.50)

Estimated ongoing business operations diluted

earnings per share

$9.25–$9.75

Industry demand

North America

Latin America

EMEA

Asia

Latin America

EMEA

Asia

2%–3%

3%–5%

0%–0%

3%–5%

[1] 2013 Outlook includes the expected impact of the U.S. Energy Tax Credits earned in 2012 and 2013. The benefit earned for both years will be recognized in 2013.

For the full-year 2013, we expect to generate free cash flow between $600 million and $650 million, including restructuring cash outlays of up to $245 million, capital spending of $600 million to $650 million and U.S. pension contributions of up to $140 million.

For more information, see document titled "GAAP Reconciliations" at http://investors.WhirlpoolCorp.com/annuals.cfm.