Chairman’s Message

2013 Results Whirlpool Corporation delivered record performance in 2013, successfully driving both revenue growth and margin expansion with our industry-leading brands and innovative new products:

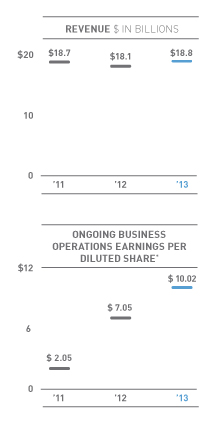

- Revenues increased more than 3 percent compared to the prior year

- Full-year ongoing business operating profit margin was 7.3 percent, up 1.6 points from 2012, as we achieved eight consecutive quarters of margin expansion

- We drove significant value for our shareholders, including higher dividends, ongoing business earnings per share of $10.02 and a 54 percent increase in the company’s stock price

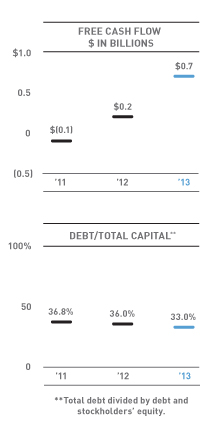

We continued to execute well on those things that we can control and, as a result, delivered more earnings than ever before. We tripled our free cash flow year-over-year to $690 million, which we effectively deployed in line with our business priorities. We increased our dividend by 25 percent during the year and repurchased $350 million in shares. In addition, we ended the year with a strong balance sheet and increased investment capacity.

Led by considerable growth in our North America and Latin America operations, we strengthened our financial position around the world with higher sales, improvements in product price and mix, ongoing cost productivity, and cost and capacity-reduction benefits. And we have set the stage to reach even higher levels of achievement in 2014.

Growth Through Brand and Product Leadership As the world’s leading global manufacturer and marketer of major home appliances, our compelling home solutions are available to consumers in nearly every country around the globe.

We invested $1.1 billion in capital, research and development in 2013. Our enhanced product development and delivery capabilities drove 50 major launches in 2013, and we were recognized around the globe for our craftsmanship, innovation and quality.

Throughout the year, we also heightened our focus on being the best in the industry at understanding consumers’ needs and desires, and we are using our deep insights to exceed their expectations through our winning products and industry-leading brands. Consumers showed strong preference for our distinctive offerings, which resulted not only in higher global sales, but also greater overall levels of profitability for our company.

We demonstrated leadership in environmental sustainability with appliances that conform to the highest standards of energy and water efficiency without compromising performance. And we continued our focus on leveraging our core appliance expertise to further develop our newer categories, like our water business.

Value Through Operating and People Excellence Our proven track record of operating discipline, while managing through global volatility, served us well in 2013. We effectively managed our costs and assets and increased productivity in all parts of our business to offset challenges in the rapidly changing external economic environment — such as higher material costs, inflation and foreign currency fluctuations. And the underlying fundamentals of our business remain strong as evidenced by our continued sales growth and margin expansion as well as our strong balance sheet.

Our 69,000 employees remain our biggest competitive advantage and the key to our long-term success. Their energy, passion and commitment to our customers reinforce our winning culture and commitment to achieve extraordinary results.

We will continue to develop the skills of our global team so that we work to our fullest ability to achieve our goals.

Global Economic Outlook Though varied by region, we are well positioned to capitalize on positive global demand trends in 2014.

Led by the United States, we expect to benefit from growth in housing, the normal replacement cycle of appliances and increasing discretionary demand. In Europe, we anticipate gradual stabilization and benefits from our ongoing turnaround actions across the region. For emerging markets, such as India and Latin America, we will continue tomanage through inflation and currency fluctuations that impact consumer sentiment. However, we see long-term growth opportunities in Brazil’s strengthening domestic market and rising middle class, as well as our business in 35 Latin American countries outside of Brazil, and we expect to see continued good growth in China.

Sustained Industry Leadership For more than 100 years, we have established a powerful platform for growth that includes the strongest brand portfolio, best distribution and leading scale.

We will continue re-investing in our business in 2014 to capitalize on our long-term growth opportunities, with increased capital expenditures, higher research and development investments, and expanded brand activities. And in China, we expect to accelerate our growth and capitalize on industry demand by completing the planned acquisition to become majority shareholder of Hefei Rongshida Sanyo Electric Co., Ltd.

Consistent execution is our commitment to you as we fulfill our long-term strategy and our priorities of:

- Growing organically and improving our mix with our robust pipeline of new, innovative products

- Further extending our home solution offerings beyond our traditional core appliance businesses into faster-growing, higher-margin adjacent businesses

- Efficiently executing our ongoing cost-productivity programs, leveraging our higher production volumes, and implementing additional cost and capacity-reduction initiatives

Our 2014 shareholder value creation targets are firmly on track, and we remain confident in our ability to drive revenue growth of 5 to 7 percent, deliver more than 8 percent ongoing operating margins and progress toward generating free cash flow of 4 to 5 percent of sales.

We are very proud of all that we achieved in 2013, and we look forward to another year of record performance in 2014 as we accelerate our profitable growth, expand our business in key markets around the world and sustain our competitive advantage.

Sincerely,

Jeff M. Fettig

Chairman of the Board and Chief Executive Officer

For more than 100 years, we have established a powerful platform for growth that includes the strongest brand portfolio, best distribution and leading scale. We will continue re-investing in our business in 2014 to capitalize on our long-term growth opportunities, with increased capital expenditures, higher research and development investments, and expanded brand activities.

— Jeff M. Fettig