At Whirlpool Corporation, we took decisive actions in 2011 to position our business for

long-term growth in the face of the global economic recession and volatility. We achieved

positive results, improving product price and mix and significantly lowering inventory levels.

As a clear indication that our actions are working, our North America region realized a more

than twofold year-over-year profit improvement during the fourth quarter.

We are committed to driving further growth through our brand value-creation strategy — focusing

on margin expansion by delivering consumer-relevant innovation, providing the industry’s best

service to the trade and our consumers, and driving lower costs and higher product quality in

every aspect of our business.

2011 RESULTS

Our actions in 2011 created increased efficiencies and positioned the business for sustained growth

and value creation. These steps were important in the face of high material costs and soft demand

that continued globally throughout 2011. The North America market remained at recessionary lows,

and we saw high inflation and low consumer confidence slow the rapid growth rates that we have seen

the last two years in emerging markets. Europe remained the most challenging region from an international

perspective as the European financial crisis drove particularly weak consumer demand across the euro zone.

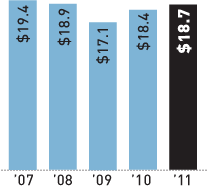

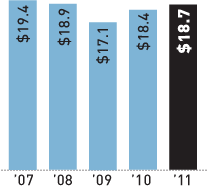

Revenue

$ in billions

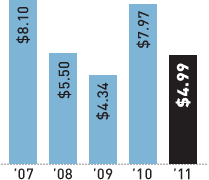

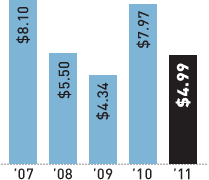

Our revenues grew 2 percent to $18.7 billion in 2011, and diluted net earnings per share were

$4.99 compared to $7.97 in 2010. This was largely due to higher material and oil-related costs

of approximately $450 million.

We exited 2011 with positive momentum, and we are well positioned for margin expansion and

earnings growth in the coming year. In 2012, we will execute strong actions to continue to improve

operating margins through our capacity and cost-reduction initiatives, ongoing productivity programs,

improved product price and mix, and by accelerating our new higher-margin product innovation to the

marketplace. These efforts will provide opportunities for growth in 2012 and throughout our second

century of operation.

We continued to drive strong cash flow from ongoing business operations, allowing us to fund

approximately $650 million of legacy liabilities in 2011. We maintained a strong financial position,

solidified with a $1.1 billion cash balance at the end of the year. For the year, we paid $148 million

in dividends. This includes the 16 percent dividend increase announced in April, demonstrating our

commitment to provide consistent returns to shareholders.

We took important steps during 2011 to promote a fair and open global trading system, to protect

American jobs and ensure our ongoing ability to innovate and invest in the United States, our largest

market. We will continue to take every action to protect our consumers, employees, shareholders and

the integrity of the U.S. appliance manufacturing industry.

2011 HIGHLIGHTS

Our investments in 2011 — our 100th Anniversary year — are yielding positive results as

we continue to see strong consumer preference for our innovative new product offerings

driving improvement in product mix around the globe. Our efforts were recognized externally

with awards for design, sustainability and innovation, including recognition on Fast Company

magazine’s 10 Most Innovative Consumer Products Companies list. Following are just a few

other recognitions that we received during the year:

-

Whirlpool Corporation was named one of Fortune magazine’s World’s Most Admired

Companies, ranking No. 1 in the Home Equipment, Furnishings industry sector.

-

Whirlpool Corporation was named on the 2011 list of Top Companies for Leaders, ranking

ninth globally and sixth in North America.

-

Whirlpool Corporation was named one of the Most Respected U.S. Companies by Forbes

magazine and the Reputation Institute. This is the fourth consecutive year Whirlpool

Corporation has been included in the Most Respected U.S. Companies list. Whirlpool

Corporation was ranked 14th on the list.

-

Whirlpool Corporation was named one of Corporate Responsibility magazine’s 100 Best Corporate

Citizens. This marks the ninth time the company has been named to the list.

-

Whirlpool Corporation was named one of DiversityInc magazine’s Top 50 Companies for Diversity.

-

For the third year in a row, Whirlpool Corporation was recognized as one of the top 500 U.S.

companies in Newsweek magazine’s Green Rankings.

-

Whirlpool Corporation was awarded a 2011 ENERGY STAR®

Sustained Excellence award — the

highest ENERGY STAR award — by the U.S. Environmental Protection Agency. This is the

company’s 12th ENERGY STAR award and sixth consecutive top Sustained Excellence win.

Diluted Earnings per Share from Continuing Operations

We improved our industry-leading quality position around the globe during 2011. Our efforts gained

recognition by a leading U.S. consumer magazine, which found that many of our appliances last

longer and are more reliable than competitors’ appliances in the refrigeration, cooking, laundry

and dishwasher categories for Whirlpool, Maytag, KitchenAid, Jenn-Air and Amana

brands. As just one category example, Whirlpool Corporation brands took 11 of the top spots

in front and top-load washer rankings.

INNOVATION THAT CONSUMERS DESIRE

We know our long-term growth opportunities are abundant, and we will continue to invest

in consumer-relevant innovation, appliance growth in new and emerging markets, expansion

into higher-margin, faster-growing adjacent businesses, and advancement of our global brand

portfolios.

Keeping our core appliance business healthy and growing is critical to our success. Innovation

is the fundamental driver of our growth — as it has been for the last century — and we invest

more than $500 million annually in Research & Development. We have seen time and time again

that, while competitive price promotions may deliver short-term market share gains, only strong,

preferred brands with consumer-relevant innovation win in the long term.

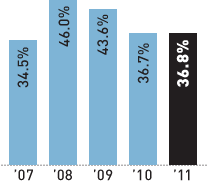

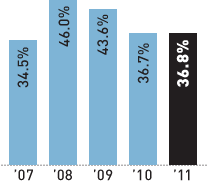

Debt/Total Capital(1)

We are increasingly able to leverage the strength of our global brand names by expanding into

higher-margin, faster-growing product lines that complement our core appliance business.

Today, branded consumer product businesses outside our traditional core — including garage

organization, countertop appliances and water filtration — represent approximately 22 percent

of our annual revenues and are growing at a double-digit pace.

In addition, we expect to see growth in emerging markets as more consumers are able to purchase

appliances and benefit from the quality and convenience they provide. The potential in developing

countries is tremendous if we consider the population and economic growth trends as well as the

very low appliance penetration levels.

We believe people everywhere deserve a comfortable place to call home with access to fresh food,

clean clothes and drinking water. Whether it is to provide basic refrigeration to a consumer in India

or a water- and energy-efficient laundry pair to a consumer in Germany, we stand ready to improve

the lives of consumers each and every day all around the world.

2012 PRIORITIES

We are executing robust initiatives to continue to improve operating margins in 2012 through

a strong cadence of innovation, capacity and cost-reduction initiatives, ongoing productivity

programs and previously announced price increases.

The restructuring actions we announced in October are on track to substantially reduce our

structural fixed costs in order to strengthen our business and deliver value-creating results

for our customers and shareholders. We expect to realize $200 million in fixed cost savings

in 2012, and an additional $200 million in 2013, or $400 million in annualized cost savings

in 2013 and thereafter.

In addition, we expect to return to more normal levels of positive net productivity. Driving

lower costs and higher product quality across our global operations allows for additional

resources to invest in the critical innovation needed to fuel the business.

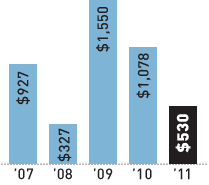

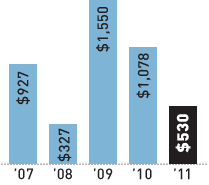

Cash Flow Provided by Continuing Operating Activities

$ in millions

In the second half of 2011, we started to realize benefits from previously announced cost-based

pricing actions. Momentum will continue and margins are expected to expand as these price

increases carry into 2012, and we see the results from additional cost-based price increases that

went into effect in January of this year in several other markets.

Collectively, these priorities, despite a still-weak global economy, will enable us to have a strong

year of operating performance improvement.

RIGHT FOUNDATION FOR SUCCESS

As we begin 2012 — and our second century of operations — I am optimistic

about the opportunities we have created at Whirlpool Corporation to deliver positive results

and win in the marketplace. We are positioned to drive sustained future growth and create

value for our shareholders, our employees and the consumers who use our products in

their homes every day.

We have empowered our people to do what no other appliance company can match —

to Improve Lives … One Home, One Family at a Time … through World-class Products

and Services. We make household chores easier so that families can spend more time

together. This clear sense of purpose unifies our global workforce and inspires the

society-transforming innovations that ultimately drive profitable growth and create

shareholder value.

Sincerely,

Chairman of the Board and Chief Executive Officer